Shriram Insight has invested heavily in technology to provide best in class trading platforms in the market. Our developers are constantly working on newer, better and faster technology solutions to give you an edge over other traders in the market. Shriram Insight offers access to many powerful trading platforms through your same Login code.

Our advanced and seamlessly integrated flagship Shriram Netpro trading platforms : Mobile, Browser, Desktop

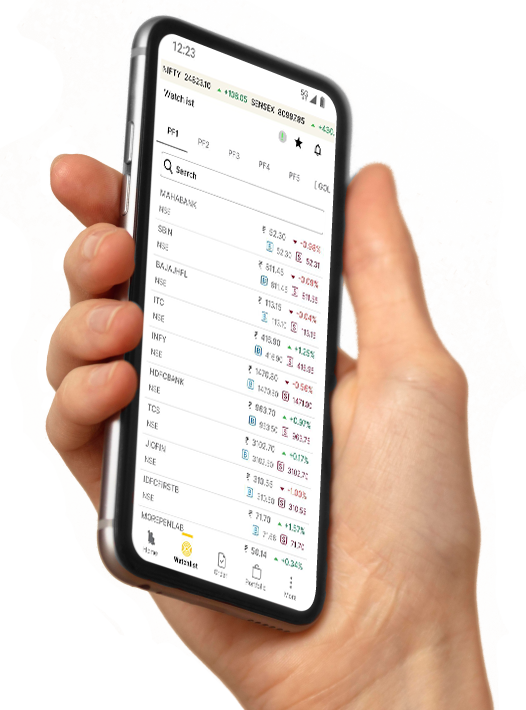

Shriram Netpro Mobile platform lets retail traders quickly and easily access the finanical markets. Trades can be placed and managed on the go through its simple, intuitive interface, which was designed from the ground up to function beautifully on mobile devices.

Download App

Shriram Netpro Browser platform allows quick and easy access to the financial market from nearly any computer with an internet connection. There is no software to download and the platform works on popular broswers.

Shriram Netpro Desktop platform is our innovative trading software, designed with you in mind.